In the rapidly evolving world of cryptocurrency, mining has become an essential aspect of the ecosystem. With the increasing demand for cryptocurrencies and the corresponding rise in their prices, the mining industry has boomed. One of the most crucial steps in cryptocurrency mining is the selection and purchase of a reliable and efficient crypto miner for sale. However, with numerous options available in the market, choosing the right miner for your needs can be a daunting task.

In this comprehensive guide, we will delve into the world of crypto miners for sale, exploring their benefits, technical specifications, and the best places to buy or sell them. Our goal is to equip you with the knowledge you need to make informed decisions and unlock the full potential of your crypto wallet.

Introduction to Crypto Mining and Miners

Before we dive into the details of crypto miners for sale, let’s briefly cover the basics of cryptocurrency mining.

What is Cryptocurrency Mining?

Mining refers to the process of verifying transactions on a blockchain network, which is the underlying technology behind most cryptocurrencies, including Bitcoin, Ethereum, and Altcoins. The process involves solving complex mathematical equations to validate transactions, and the person solving the equation is rewarded with newly minted cryptocurrency.

What is a Crypto Miner?

A crypto miner is a specialized computer designed specifically for cryptocurrency mining. The miner is equipped with high-performance hardware, including graphics cards (GPUs) or application-specific integrated circuits (ASICs), which are designed to perform the complex mathematical calculations required for mining. Antminer s15 miner for sale

Benefits of Using a Crypto Miner for Sale

The benefits of purchasing a crypto miner for sale are numerous:

- High Returns: By mining cryptocurrencies, you can earn significant returns on your initial investment.

- Passive Income: Once you’ve set up your miner, it can run continuously, generating profits even while you’re not actively working.

- Increased Accessibility: With a crypto miner, you can mine cryptocurrencies without needing a large amount of computational power or technical expertise.

- Competitive Advantages: Having a crypto miner can give you a competitive edge in the market, allowing you to mine cryptocurrencies more efficiently and profitably.

Understanding the Benefits of Purchasing a Crypto Miner for Sale

Purchasing a crypto miner for sale can bring numerous benefits to your cryptocurrency mining journey. One of the primary advantages is the potential for high returns on your investment. A well-designed miner can mine cryptocurrencies at high speeds, generating significant profits over time.

How to Choose the Right Crypto Miner for Your Needs

Choosing the right crypto miner for your needs requires careful consideration of your requirements, budget, and available space. Here are some key factors to consider when selecting a miner:

- Hashrate: Choose a miner with a high hashrate, which determines the rate at which the miner processes transactions.

- Energy Consumption: Consider energy-efficient miners to minimize your electricity costs.

- Noise Level: If you plan to run your miner in a home or office, consider a low-noise model.

- Cooling System: Ensure the miner has a reliable cooling system to prevent overheating.

- Compatibility: Choose a miner compatible with your preferred cryptocurrency.

Technical Specifications to Consider

When evaluating crypto miners for sale, consider the following technical specifications:

- GPU or ASIC: Decide whether you need a GPU or ASIC-based miner, depending on your cryptocurrency choice.

- Memory: Ensure the miner has sufficient memory to process transactions efficiently.

- Motherboard: Choose a miner with a sturdy motherboard to withstand the rigors of continuous operation.

- Power Supply: Select a miner with a reliable power supply to prevent equipment damage.

Where to Buy Crypto Miners for Sale: Top Options Revealed

When purchasing a crypto miner for sale, it’s essential to consider the reliability and authenticity of the seller. Here are some top options:

- Mineurs World: As one of the leading online marketplaces for crypto miners, Mineurs World offers a vast selection of miners from renowned manufacturers.

- Amazon: Amazon offers a broad selection of crypto miners from various sellers, often with free shipping and returns.

- Newegg: As a dedicated computer hardware store, Newegg offers a range of crypto miners with competitive pricing and fast shipping.

Mineurs World: Your One-Stop Shop for Crypto Miners

If you’re looking for a single platform to find the perfect crypto miner for sale, Mineurs World is your go-to destination. With an extensive catalog of miners from top manufacturers, you can browse and compare products to find the ideal miner for your needs.

Tips for Selling Your Used or Second-Hand Crypto Miner

If you’ve upgraded to a newer miner or no longer need your existing one, consider selling it on Mineurs World or other online marketplaces. Here are some tips to get you started:

- Determine the Value: Research the current market price of your miner to determine a fair selling price.

- Clean and Prepare: Ensure the miner is in good condition, clean, and ready for sale.

- Take Quality Photos: Include high-quality photos of the miner to showcase its condition.

- Write a Detailed Description: Provide a detailed description of the miner, including its specifications and features.

The Importance of Proper Maintenance and Upgrades

To ensure your crypto miner operates efficiently and effectively, it’s essential to perform regular maintenance and upgrades:

- Clean the Miner: Regularly clean the miner to prevent dust buildup and overheating.

- Update Firmware: Update the miner’s firmware to ensure it remains compatible with the latest cryptocurrency protocols.

- Replace Components: Replace worn-out components, such as fans or capacitors, to maintain optimal performance.

Conclusion: Why You Need to Invest in a Crypto Miner for Sale Today

In conclusion, purchasing a crypto miner for sale can be a game-changer for your cryptocurrency mining endeavors. With the right miner, you can unlock high returns, passive income, and competitive advantages in the market.

When choosing a miner, consider factors like hashrate, energy consumption, noise level, cooling system, and compatibility. Technical specifications, such as GPU or ASIC, memory, motherboard, and power supply, are also crucial considerations.

By following this comprehensive guide, you’ll be well-equipped to select the perfect crypto miner for your needs and take your cryptocurrency mining journey to the next level.

Call-to-Action: Visit Mineurs World today and discover the best crypto miners for sale. Whether you’re a seasoned miner or just starting out, our expert team is here to help you unlock the full potential of your crypto wallet.

Paula WehbehHead of Business Strategy, Ellington Properties

Paula WehbehHead of Business Strategy, Ellington Properties

eToro

eToro Coinbase

Coinbase

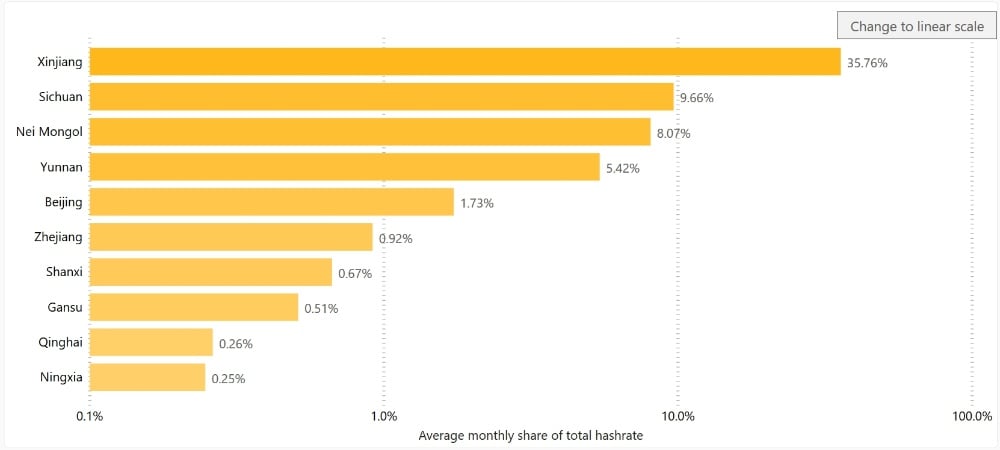

Map showing percentage of total Bitcoin mining in each province

Map showing percentage of total Bitcoin mining in each province Here is an alternative view of that data if you aren’t familiar with China’s geography

Here is an alternative view of that data if you aren’t familiar with China’s geography David Stanway, Reuters

David Stanway, Reuters One of Sichuan’s many hydroelectric dams

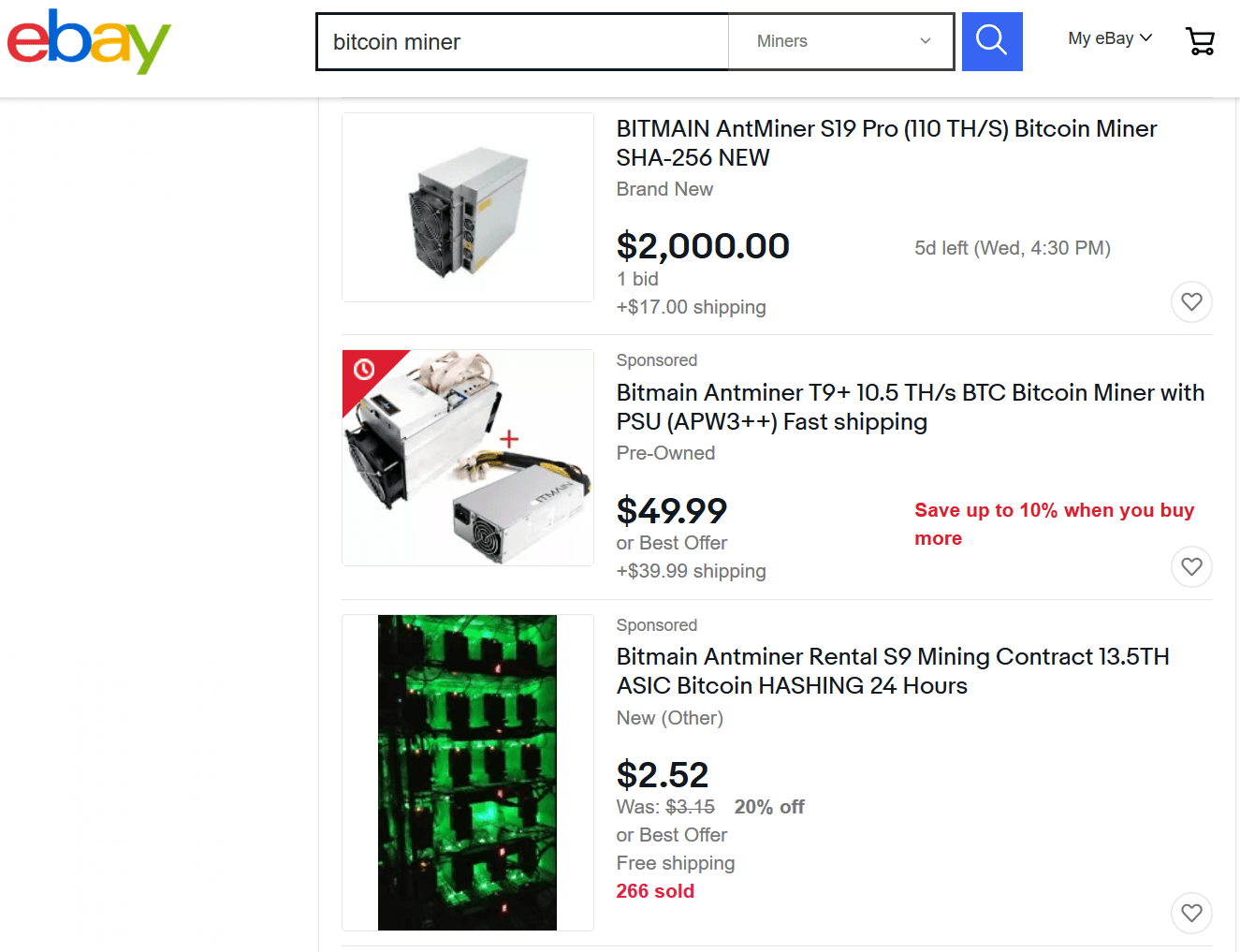

One of Sichuan’s many hydroelectric dams ASICs for sale on Ebay

ASICs for sale on Ebay Photos from inside a Chinese Bitcoin mining operation

Photos from inside a Chinese Bitcoin mining operation